Moneyball is a fortnightly newsletter from Koble exploring the limitations of human decision-making and their implications for startup investing.

We’ve spent two years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of success.

This week

🧠 Mental Model #29 – BS Asymmetry – Building a Venture Capital BS detector

📖 Investor reading – LP Perspectives 2024: investors in VC funds are super unhappy – Moore’s McIntyre to lead venture firm with Daily Mail backing – Funding for European technology companies plunges by nearly half

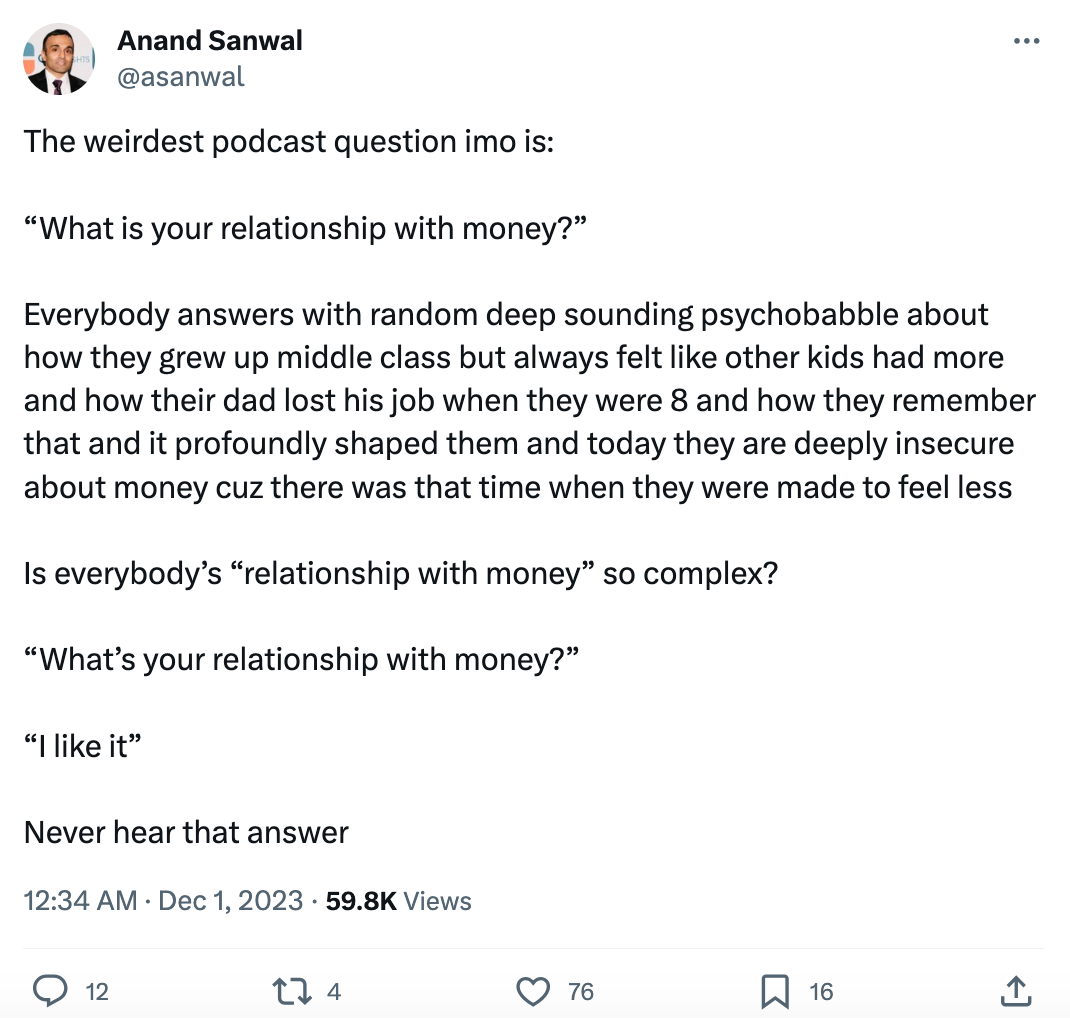

💬 Some tweets – What is your relationship with money? – This early stage investing thing – The most brutally honest takes I’ve read of what it’s like to work in VC

Happy holidays

As we enter the VC blackout period, we wanted to wish everyone who reads (an hopefully enjoys) Moneyball a very happy holiday season, and a strong start to 2024.

It’s been a tough year for our industry. But we shall overcome. Startup investing is bigger than the economic cycle.

Building a Venture Capital BS detector

“The amount of energy needed to refute BS is an order of magnitude bigger than to produce it.”

– Alberto Brandolini

BS Asymmetry – also known as Brandolini’s Law after it was coined in January 2013 by Alberto Brandolini, an Italian programmer – highlights the immense difficulty of debunking false information.

George Bernard Shaw once pointed out that “false knowledge [...] is more dangerous than ignorance”. In the contemporary media environment – once characterised by Fake News, frictionless information transfer, and ideological zeal – we would do well to treat all information with a healthy dose of skepticism.

BS Asymmetry is by no means a new idea. Way back in the 1700s, Jonathan Swift (a man who elevated satire into an art-form) wrote that:

“Falsehood flies, and truth comes limping after it.”

Swift identified an asymmetry that handicaps people everywhere. It all boils down to a disparity in standards of evidence. It’s much, much easier to suggest that something might be true than it is to demonstrate conclusively that it’s not the case.

In other words, it’s easier to fool people than to convince them that they have been fooled.

And the scientific method is not a panacea. In fact, scientific results themselves are vulnerable to BS Asymmetry.

A single experiment with anomalous results can grab headlines and get everyone talking (and believing), but it takes a mountain of effort to repeat the same results. The “Replication Crisis” that’s currently plaguing academic fields as diverse as physics, medicine, economics, and engineering, is a case in point – the results of many scientific studies are difficult to reproduce, calling into question the extent of scientific knowledge.

We should also beware the knock-on effects of BS Asymmetry. Well-intentioned efforts to discredit BS can (and often do) have the opposite effect, as highlighted by the curious case of “Morgellons Disease”.

After watching a TV news report in February 2005, scores of people became convinced they were suffering from an alarming skin condition called “Morgellons”. The news segment was in fact a misguided attempt to explain how reports of an undefined disease were generating momentum in an obscure corner of the Internet. But it led to a surge of people discovering strange fibres growing out of their skin.

More than a decade later, self-diagnoses of Morgellons persist. Most healthcare providers recognise the condition as a delusion, treating it with antidepressants, antipsychotic drugs, cognitive behavioral therapy and counseling.

Implications for investors

The BS Asymmetry Principle is especially problematic for investors.

VCs are constantly scanning the horizon for information that might give them an edge in the remorselessly challenging world of startup investing. Refuting false information is resource-intensive. It takes time to validate the facile claims of strangers on the Internet. And we cannot account for the credulity of others. Information that we reckon to be false can still move markets, often out of our favour.

One way to mitigate this effect is to employ Hitchen’s Razor. Investors should remind themselves that “what can be asserted without evidence can also be dismissed without evidence”. We can use this method, for example, to refute Brandolini’s hyperbolic claim that, “the amount of energy needed to refute BS is an order of magnitude bigger than to produce it.” One cannot help but think he was playing a joke on us all with such an unsubstantiated claim!

But there is another, more rigorous way to take back control of the startup evaluation and investment process.

Mathematics is a singular domain in which BS is easier to detect and refute. In the world of math, it’s much harder for someone to make a false claim that cannot be shown to be untrue (at least to someone who understands mathematics).

Venture Capital is perhaps the least quantitative asset class of all. Whilst fixed-income, commodities, options trading, and other financial domains attract people with quant expertise, VC is mostly home to multi-disciplinary all-rounders who emphasise soft skills over technical chops.

Very few have applied a mathematical lens to the business of investing in startups, which is perhaps why our industry has changed little since its inauguration in the mid Twentieth Century. This lack of analytical rigour leaves startup investors vulnerable to BS – from founders, intermediaries, journalists, even themselves.

“Quant VC” promises to change that; to transform the dark art of Venture Capital into a science. By structuring massive volumes of information into usable datasets and pairing them with groundbreaking proprietary algorithms, we can transform the process of sourcing, evaluating, and investing in startups.

This goes beyond the current trend towards “Data-driven” investing to create a startup investment process that’s systematic and non-human.

The cold, emotionless logic of math can transform startup investing. We can use AI to build a (much needed) BS detector for Venture Capital, evolving the asset class and unlocking massive value for founders, investors, and the society.

Work with Koble

At Koble, we’ve spent two years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of success.

We’re working with forward-thinking angels, VCs, family offices, and hedge funds to re-engineer startup investing with AI. If that resonates, get in touch.

Investor reading

😓 LP Perspectives 2024: Investors in VC funds are super unhappy – Venture Capital Journal surveyed 117 institutional investors worldwide to find out what is most (and least) important to investors in venture funds.

🤑 Moore’s McIntyre to lead venture firm with Daily Mail backing – Louis Bacon’s Moore Capital Management and the publisher of British tabloid the Daily Mail are launching a new venture fund.

🇪🇺 Funding for European technology companies plunges by nearly half – Start-ups on the continent are expected to raise $45bn in 2023, down from $82bn last year, as US investors pull back.

Some tweets

Parting shot

“Our knowledge can only be finite, while our ignorance must necessarily be infinite.”

― Karl Popper

Regards from your [BS-resistant] startup investing AI,

About Koble

Koble is re-engineering startup investing with AI, applying quantitative strategies that have disrupted public markets to early-stage startup investing.