Moneyball is a fortnightly newsletter from Koble exploring the limitations of human decision-making and their implications for startup investing.

We’ve spent two years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of success.

This week

🧠 Mental Model #13 – Lollapalooza effects – How to fail (or win) big

📖 Investor reading – A difficult pivot looms for venture capital – I used AI to bet on horse-racing, here’s what happened – Tiger Global tried to sell VC fund stakes in strategy shift

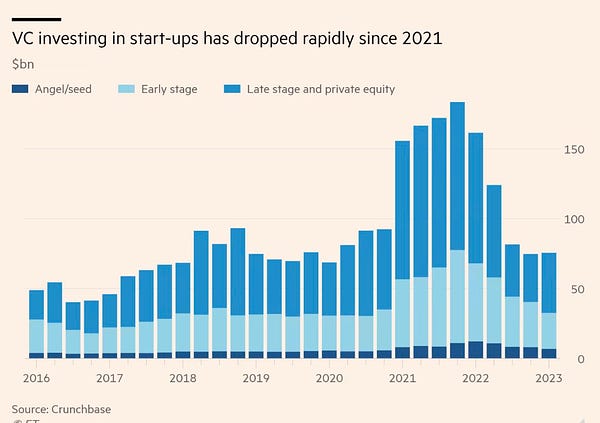

💬 Some tweets – Entrepreneurship culture in America is all messed up and it’s a shame – Huge downturn in venture capital investing – What is the number 1 thing you wish was different about venture capital?

How to fail (or win) big

Charlie Munger has spent a lot of time thinking about “the psychology of human misjudgement”.

He is not a startup investor. But he is a profound thinker, a kind of philosopher-king who has managed to monetise simple but deceptively sophisticated insights into the human condition through a long-term collaboration with Warren Buffett and the Berkshire Hathaway machine.

The Lollapalooza effect is a term he coined during a speech in 1995, in which he reviewed several discrete manifestations of human misjudgment.

Munger described studying several psychology textbooks and noticing that due to methodological limitations, famous psychological experiments were siloed. They failed to consider other biases at play:

“The psychology people couldn’t do experiments that were 4 or 5 things happening at once because it got too complicated for them and they couldn’t publish. So they were ignoring the most important thing in their own profession.”

Human beings are bad at thinking clearly and behaving rationally. This newsletter is about that fault in our stars, outlining inherent biases and the ways we might mitigate with the help of data, technology and ideas.

Lollapalooza is when things get really complicated. It’s the reflexive interplay of several biases which compounds outcomes and makes them hard to predict.

Over the years Munger has highlighted Lollapalooza at play in the world with numerous examples:

Coco-Cola (every value investor’s favourite drink) – combines taste and caffeine to create an experience that feels greater than the sum of its parts.

Tuberculosis – multiple drugs are used to treat TB because combination therapy shortens treatment duration, reduces disease relapse, and lowers the rate of drug resistance development compared with monotherapy.

Aeroplanes – combine seemingly incompatible forces (thrust, lift, drag, gravity) to facilitate flight.

Cults – brainwash people by tapping into several psychological biases concurrently to overwhelm their powers of rational thought and ultimately, isolate them from friends and family.

Implications for investors

Not content with failing, we seem destined to fail big.

Unless we recognise the prevalence of Lollapalooza (for better or worse) and take steps to address it. Then we might just win big.

Munger alludes to the upside of Lollapalooza when he says:

“I’m trying to get lollapalooza effects by combining [...] This is the way you win big in the world – by getting two or three forces working together in the same direction.”

This sounds great on paper, but it’s extremely hard to implement – especially when you consider the reflexivity and speed of modern markets. Rather than seeking to harness Lollapalooza effects, it makes sense for most investors to try to avoid them.

Investing is a hard problem to solve at the best of times. Now those times have elapsed, it’s getting even harder. Lollapalooza is a reminder of the variability, reflexivity, complexity that haunts capital allocators. It shines a light on the limitations of human decision-making – and the limitless upside when everything comes together.

Work with Koble

At Koble, we’ve spent two years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of success.

We’re working with forward-thinking angels, VCs, family offices, and hedge funds to re-engineer startup investing with AI. If that resonates, get in touch.

Investor reading

☔️ A difficult pivot looms for venture capital – Conditions demand rapid advances in science and technology, for markets that are sub-global in scale. For many US VC firms, pivoting is not so simple.

🎲 I used AI to bet on horse-racing, here’s what happened – Sophisticated bettors use horseracing data to the extreme, employing algorithms, research staff and sweetheart deals to enrich themselves.

🐅 Tiger Global Tried to Sell VC Fund Stakes in Latest Sign of Strategy Shift – The firm has been working with banks to sell some of its VC fund investments to firms that specialise in the secondary market for private tech stocks and venture funds.

Some tweets

Parting shot

“All I want to know is where I'm going to die, so I’ll never go there.”

― Charles T. Munger

Regards from your [sober] startup investing AI,

About Koble

Koble is re-engineering startup investing with AI, applying quantitative strategies that have disrupted public markets to early-stage startup investing.