Moneyball is a fortnightly newsletter from Koble exploring the limitations of human decision-making and their implications for startup investing.

We've spent two years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of being successful.

This week

🧠 Mental model #5 – Nonlinearity – Pain, Coffee, and Nonlinearity

📖 Investor reading – The crypto mess – Diversity VC Releases – The startup and venture markets are coming back to square one

💬 Some tweets – Always talk to the CTO – A horrible VC – Work-life balance while fundraising

Pain, coffee, and nonlinearity

Nonlinearity has a habit of showing up everywhere.

It can be a welcome presence. And it can be a complete pain in the backside (the latter unfortunately being more commonplace than the former).

When we say everywhere, we mean everywhere. 96% of the human genre is shared with chimpanzees. Superficially then, we’re similar to chimps. But that measly 4% differential creates profound differences in our physical appearance, cognitive abilities, and behaviour.

Then there’s sleep, that thing we used to do before we started Koble.

Dr. Matthew Walker’s book “Why We Sleep” notes that thanks to the power of compounding, the difference between a regular 8 hours of sleep and 7 hours is not just 10-15%. It’s the difference between being able to function normally, and behaving like a zombie.

And what about pain?

Turns out that pain relief is non-linear too. At low doses, 2 Paracetamol are better than 1. But pain is multi-causal and painkillers only work on specific neural pathways, so the benefits of consuming more pills rapidly diminish. Consume over 3,000mg per day (just six 500mg pills) and you’ll cause irreversible damage to your liver.

As the dosage-efficacy curve flattens, benefits soon become drawbacks. The same is true of coffee; 1 or 2 cups might make you more productive. 10 cups will ruin your day.

Understanding nonlinearity and its implications for performance leads to behavioural change.

Our performance as investors, founders, and people is more important than another hour of Netflix, another cup of coffee, a pill taken to mask a structural issue.

A key offshoot of nonlinearity is the concept of dose dependency. And it’s a problem that affects high performers (particularly founders) more than everyone else.

The belief that “if something is good then more of it is even better” leads to massive problems. As American author (and the genius behind the Dilbert cartoons) Scott Adams has wryly observed:

“There's nothing more dangerous than a resourceful idiot.”

The most obvious example is founders who try to hustle their way to success with an approach that’s fundamentally flawed. If your product, distribution, and operations are wrong, pumping in more effort is only going to make things worse.

Implications for investors

The same logic can be applied to investing.

Are you trying to muscle your way to success with more people and processes? Are you convincing yourself that you need to see ever more deal flow to find outliers, when you haven’t found ways to improve analysis of your existing pipeline? Or are you leveraging technology and data to make smarter decisions?

Our intention with this newsletter is to explore how mental models can make us better people. Becoming better investors is simply a by-product of this endeavour.

And in life, the difference between working hard and working smart is often the difference between failure and success. Combine hard and smart and you get something very powerful.

Investing too is nonlinear in so many ways. Compound interest creates opportunities to build exponential wealth in boring asset classes. Startups portfolios are governed by power laws that distort perceptions. Macroeconomic tail-risks can wipe out even the most diversified portfolios.

Painkillers, coffee, startups. These things go well together. To get the most out of them, it pays to respect the omnipresence of nonlinearity in our lives and portfolios.

Work with Koble

At Koble, we've spent two years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of being successful.

We’re working with forward-thinking angels, VCs, family offices, and hedge funds to re-engineer startup investing with AI. If that resonates, get in touch.

Investor reading

🤩 The Sorry Saga of Bankman-Fried – The adoring star-gazing of Sam Bankman-Fried casts shame on media scribes and gullible investors alike.

💰 Diversity VC releases report – Uncovers new data and discrepancies of venture capital-backed diversity, equity and inclusion investments.

🤖 The startup and venture markets are coming back to square one – It’s clear that the 2020-2021 boom in software valuations was more of an anomaly than a new normal.

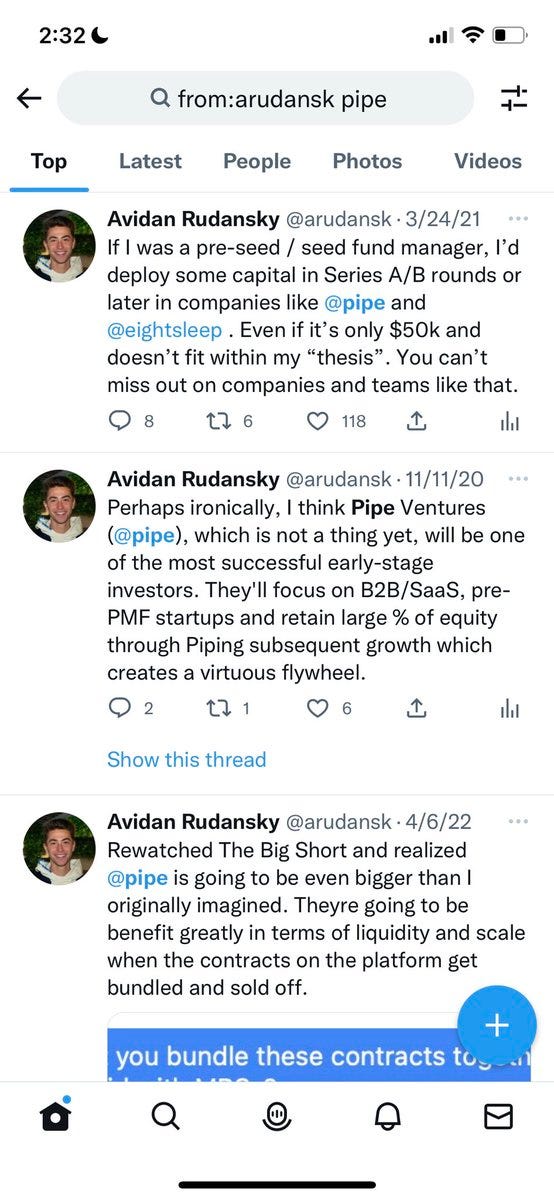

Some tweets

Parting shot

“What important truth do very few people agree with you on?”

– Peter Thiel

Regards from your [quietly reflective] startup investing AI,

About Koble

Koble is re-engineering startup investing with AI, applying quantitative strategies that have disrupted public markets to early-stage startup investing.