Moneyball is a newsletter from Koble exploring the limitations of human decision-making and their implications for startup investing.

We’ve spent four years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of success.

This week

🧠 Mental Model #34 – Something Beautiful – On Beauty

📖 Investor reading – Venture group G Squared raises $1bn to invest in discounted startup shares – Can China Tech Find a Home in Silicon Valley? – The Venture Capital Reset Era

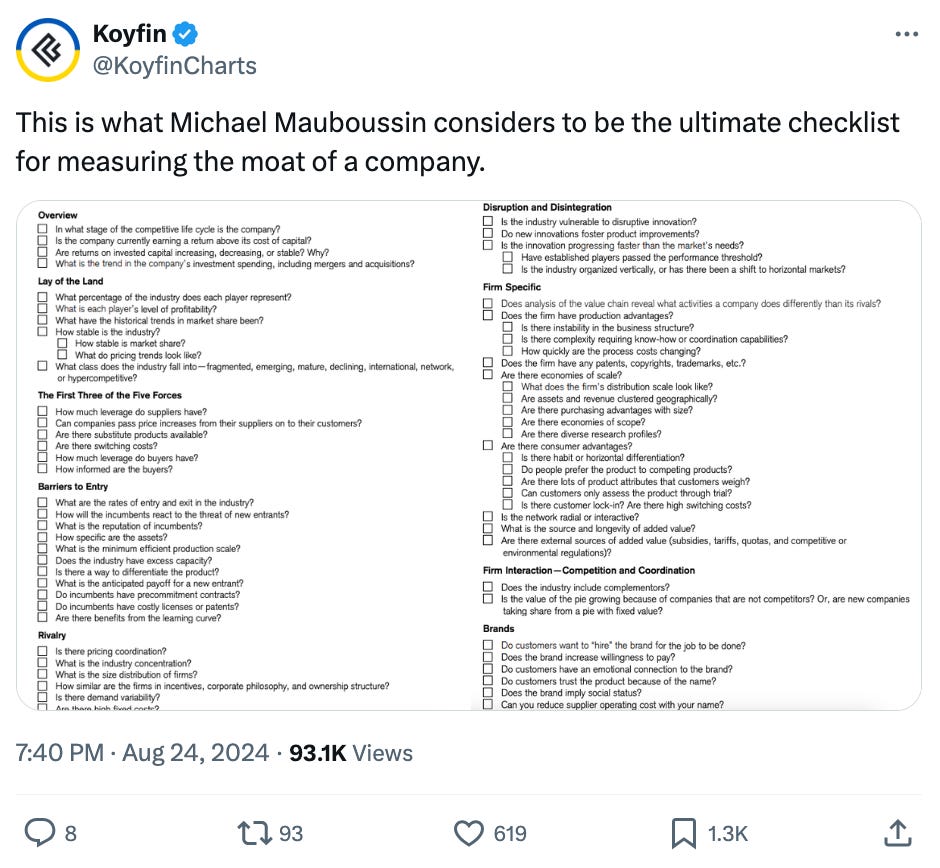

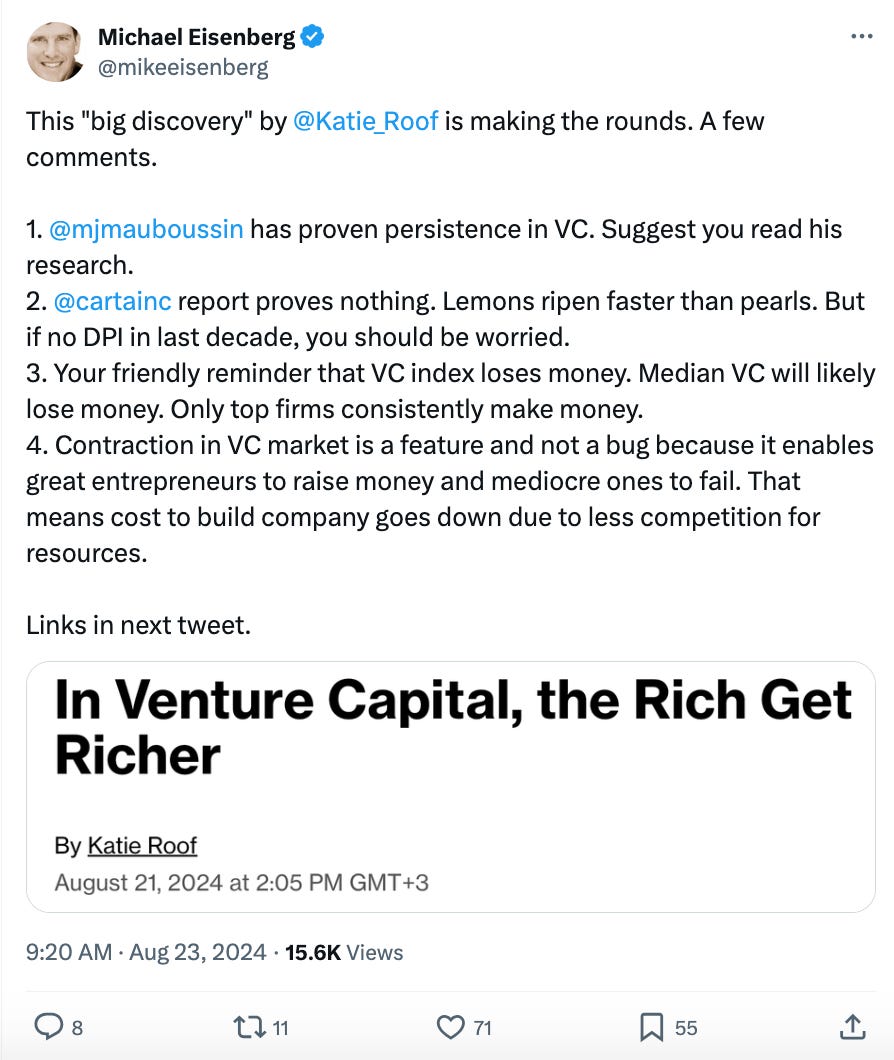

💬 Some tweets – The biggest problem in venture and LP land today – Ultimate checklist for measuring the moat of a company – Your friendly reminder that VC index loses money

Something Beautiful

What is beauty? And what does it have to do with startup investing?

On 10th May 2024, an extraordinary person passed away. He was a professor of mathematics, NSA code breaker, chain smoker, quantitative hedge fund manager, and philanthropist, giving over $4 billion to good causes during his lifetime. He famously did not wear socks. And he was and one of the most successful investors of all time.

Jim Simons was one of those rare individuals that manage to transcend academia and markets, using abstract theories to capture real-world profits.

He helped to developed the Chern–Simons form and contributed to the development of string theory by providing a theoretical framework to combine geometry and topology with quantum field theory. And as the creator of Renaissance Technologies – one of the world’s first quantitative hedge funds – he found a way of monetising his studies on pattern recognition.

Medallion, Renaissance’s main fund which is closed to outside investors, has earned over $100 billion in trading profits since its inception in 1988. This translates to a 66.1% average gross annual return or a 39.1% average net annual return between 1988 – 2018.

All of this is well known. The investment world is replete with imitation – we naturally seek to deconstruct and replicate the success of others.

What’s far more interesting and valuable is the role of beauty in Simons’ life and work.

He said:

“Be guided by beauty . . . it can be the way a company runs, or the way an experiment comes out, or the way a theorem comes out, but there’s a sense of beauty when something is working well, almost an aesthetic to it.”

For Simons, beauty occurred in many forms, as outlined by Greg Zuckerman’s thrilling book about his life, “The Man Who Solved The Market”. Beauty is complex, subjective, and multi-faceted. In Simons’ world, it encompassed a range of different experiences – finding math theorems, market pricing discrepancies, building multi-disciplinary teams, and yes, generating outstanding returns.

Implications for investors

Other people see beauty. It is attractive in a literal sense, pulling talent towards talent and creating opportunities for massive breakthroughs.

It is significant that Simons tended to hire specialists with non-financial backgrounds, including mathematicians, physicists, signal processing experts and statisticians, whose relationships with numbers were different to those of traders and other traditional money-makers. People guided by beauty.

Confucius observed that:

“Everything has beauty, but not everyone sees it.”

Beauty is a strange and intangible concept. It doesn’t seem relevant to the cold, precise world of quantitative investing. But it is there, hiding in plain sight. Some people are simply more attuned than others to finding beauty and sharing it with others.

Simons was one such person. He could feel the beauty of mathematics and channel it into something pragmatic and lucrative. He was a translator, decoding the hidden meaning of numbers and their interrelationships to his colleagues and investors.

What else can we learn from Jim Simons’ belief in beauty? How can we make our investments more beautiful? Not easy questions to answer, but certainly worth exploring.

Work with Koble

At Koble, we’ve spent four years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of success.

We’re working with forward-thinking angels, VCs, family offices, and hedge funds to re-engineer startup investing with AI. If that resonates, get in touch.

Investor reading

💰 Venture group G Squared raises $1bn to invest in discounted start-up shares – Slowdown in public listings and takeovers means staff and investors are selling shares for cheap on secondary market.

🇨🇳 Can China Tech Find a Home in Silicon Valley? – Entrepreneurs and venture capitalists are setting up firms across the Pacific, only to find that any investment with Chinese ties is a hard sell.

⏱ The Venture Capital Reset Era – “This is a time for serious people, people who take this business seriously.” The Information discusses the latest in the venture shakeout.

Some tweets

Parting shot

“I can appreciate the beauty of a flower. At the same time, I see much more about the flower than he sees. I could imagine the cells in there, the complicated actions inside, which also have a beauty. I mean it’s not just beauty at this dimension, at one centimeter; there’s also beauty at smaller dimensions, the inner structure, also the processes.”

― Richard Feynman

Regards from your [beautiful] startup investing AI,

About Koble

Koble is re-engineering startup investing with AI, applying quantitative strategies that have disrupted public markets to early-stage startup investing.