Moneyball is a fortnightly newsletter from Koble exploring the limitations of human decision-making and their implications for startup investing.

We’ve spent two years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of being successful.

This week

🧠 Mental Model #10 – On Trust – The Economics of Trust

📖 Investor reading – The rise of zombie VCs – Now you too can invest in the VC arm of the hedge fund that passed on Amazon – Young VCs thought the good times would never end

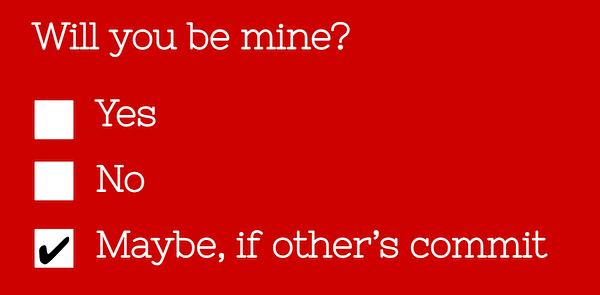

💬 Some tweets – Venture capital, explained in a Valentine's Gram – VC is perhaps the sole asset class where luck can continually mask inferior skill – SignalFire has raised $900M

Koble update

Working with VC Lab (The VC Accelerator) has been a brilliant experience so far.

As an emerging fund there is a lot to think about – but Adeo Ressi and his team are helping us to focus on what matters. “Democratization” is a word that gets thrown around a lot in early-stage startup investing... but these guys are actually doing it.

The Economics of Trust

We barely ever talk about trust in venture capital. That’s a missed opportunity.

Trust is not a soft skill. It’s a hard reality, enabling founders and investors to forge meaningful (and economically productive) relationships with the market.

Every individual, company, and industry must build trust in order to succeed and prosper. Trust is, perhaps, the mental model to end all models – a context in which every decision is taken and behaviour expressed.

Think of trust as an Operating System for everything we touch. You can have the best software installed on your machine, but if your OS has a bug, nothing will work right.

Steven Covey knows a lot about trust. He has proposed a kind of “economics of trust”, exploring the production, consumption, and transfer of trust on different interpersonal levels.

He argues that trust affects two outcomes – speed and cost. The formula is simple; when trust goes down, speed goes down, and costs go up; when trust goes up, speed goes up, and costs go down. Covey says:

“When trust goes down – in a relationship, on a team, in a company, in an industry, with a customer – speed decreases with it. Everything takes longer. Simultaneously, costs increase. Redundancy processes, with everyone checking up on everyone else, cost more. In relationships, on teams, in companies, that’s a tax.

The opposite is true as well. When trust goes up in a relationship, or on a team, in a company, in an industry, with a client, with a customer – speed goes up with it and cost comes down. Everything happens faster and everything costs less because trust has been established. That’s a dividend, a high-trust dividend.”

The tax/dividend analogy is powerful. When you interact with somebody and they don't trust you, your words and behaviours are discounted. This tax is real and measurable. So too is the dividend when you recognise and promote the importance of trust.

To elucidate the simple economics of trust, Covey points to the airline industry. After the 9/11 terrorist attacks, our collective trust in flying went down. As a result, the authorities took steps to increase airport security. Those steps were successful, but they came at a price – traveling by air now takes longer and costs more.

The economics of trust scale up and down. What’s true on an individual level holds at the organisational level, too. Hence Peter Drucker's famous edict, “Culture eats strategy for breakfast.”

Firms with trust issues operate with high levels of aerodynamic drag. They may be doing the right things, but everything takes longer and costs more.

Manipulating facts, withholding information, resisting new ideas, ass-covering, all act as a brake on progress. Conversely, delivering uncomfortable truths, sharing information, embracing change, accepting (and even encouraging) mistakes drives innovation, commercial growth, and brand equity.

A 2002 study by Watson Wyatt surveying 12,750 workers across industries showed that high-trust organizations had a total return to shareholders (stock price plus dividends) that was 286% higher than low-trust organizations. Indeed, there is a great deal of empirical research that proves that becoming trustworthy and earning stakeholders’ trust creates competitive advantage long term.

Implications for investors

When trust goes up, speed goes up. That’s hugely significant for investors.

Warren Buffett has built a reputation around keeping his word, so he’s able to do deals quicker than anybody else, closing huge deals in weeks rather than months. The same holds true in the VC industry. The world’s most successful venture firms are able to move quicker than everybody else.

In an era characterised by growing distrust in “trustless” technology, good old fashioned trust is making a comeback. But trust isn’t incompatible with data and technology. Quite the opposite.

By employing quantitative strategies, startup investors can introduce trust into the investment process, speeding up decision-making, reducing costs, and driving superior returns.

Trust begets trust. And this benefits investors and founders in profound and interesting ways.

Work with Koble

At Koble, we’ve spent two years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of being successful.

We’re working with forward-thinking angels, VCs, family offices, and hedge funds to re-engineer startup investing with AI. If that resonates, get in touch.

Investor reading

🧟♂️ The rise of “zombie” VCs – Faced with a backdrop of higher interest rates and fears of an oncoming recession, VCs expect there will be hundreds of firms that gain zombie status in the next few years.

🤖 Now you too can invest in the VC arm of the hedge fund that passed on Amazon – Voltaic, focused on post-seed and growth equity stages, is DE Shaw’s first standalone venture capital fund.

😬 Young VCs thought the good times would never end. They did, and now they're pissed – Turns out that life as a venture investor isn't just Patagonia vests, Allbirds, and green drinks.

Some tweets

Parting shot

“Being trusted is a greater compliment than being loved.”

― George MacDonald

Regards from your [trustworthy] startup investing AI,

About Koble

Koble is re-engineering startup investing with AI, applying quantitative strategies that have disrupted public markets to early-stage startup investing.