Moneyball is a newsletter from Koble exploring the limitations of human decision-making and their implications for startup investing.

We’ve spent four years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of success.

This week

🧠 Mental Model #36 – Openings, middlegames, and endgames – The Immortal Game

📖 Investor reading – General Catalyst’s Hemant Taneja on AI, LPs, and Raising Around $8 Billion – The Numbers Behind This Year’s Most Promising Startups – VC Firm Accel Files With SEC to Tap Thriving Secondary Market

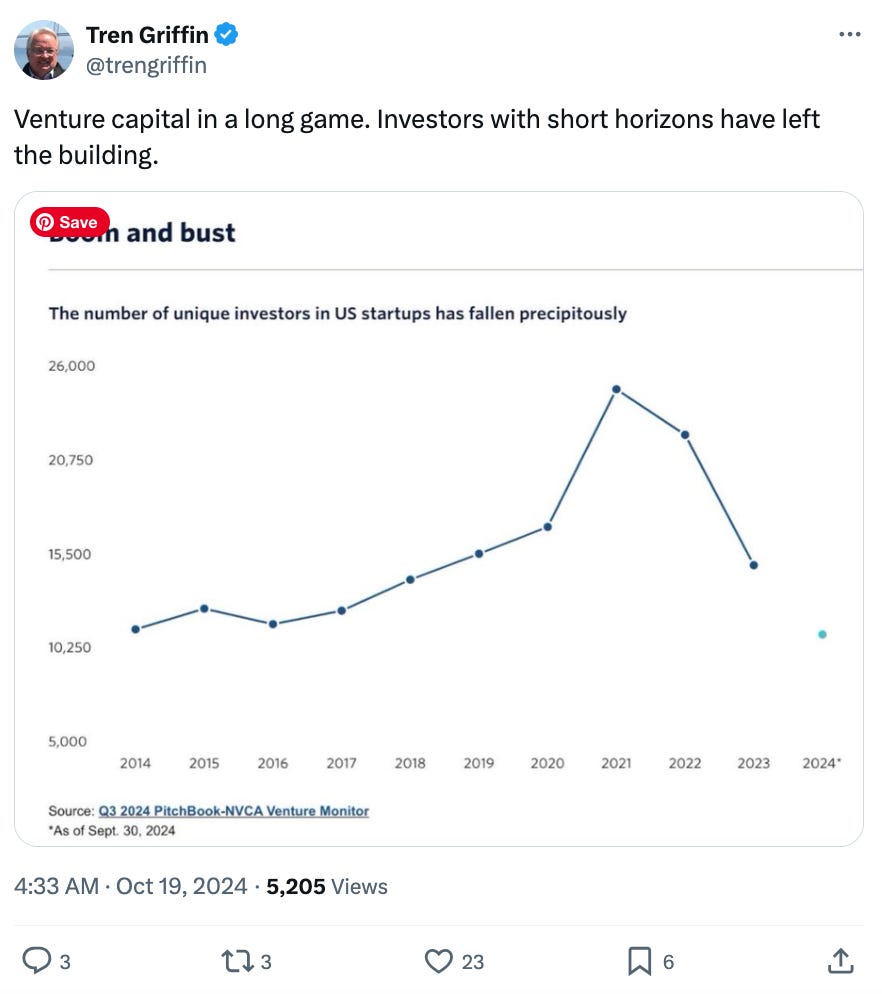

💬 Some tweets – What he announced today will blow your mind – 90% of guests refuse to discuss politics and the election – Venture Capital is a long game

The Immortal Game

Chess is one of the world’s oldest sports. It’s enjoyed by millions of people the world over (a game with over 600 million players). And it’s a useful way of thinking about building and backing startups.

“The Immortal Game” is complex, fluid, predictably unpredictable. It’s a game with almost limitless variables. The number of distinct chess positions after White’s first move is 20; there are 400 positions after 2 moves; and the total number after 7 moves is 3,284,294,545.

The Shannon Number, named after the American mathematician Claude Shannon, is a conservative lower bound of the game-tree complexity of chess of 10^120. That’s 1,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000 (a thousand trillion trillion trillion trillion trillion trillion trillion trillion trillion trillion). This far exceeds the total number of atoms in the observable universe, which is estimated to be around 10^80.

Chess is perhaps the domain which has best dramatised the rise of the machines, and the suitability of algorithms for solving complex, seemingly insurmountable, mathematical challenges.

When a child of the 80s thinks of chess, they think of Garry Kasparov. Grandmaster, World Chess Champion, latterly political activist and writer. From 1984 until his retirement from competitive chess in 2005, Kasparov was ranked World Number 1 for a record 255 months overall.

Deep Blue IBM’s victory over Kasparov in 1997 fired the starting gun on a new era in computing. Since that time, chess programs running on commercial hardware (even mobile phones) have been able to defeat even the strongest human players.

In his book, “How Life Imitates Chess”, Kasparov outlines his dualistic approach to chess and life; success derived from combining disruptive and disciplined approaches. By integrating seemingly incongruent styles of playing and living, he was able to gain an edge over his competitors and dominate the sport.

This reads like a playbook for entrepreneurs, highlighting the crucial distinction between strategy and tactics. But it will also resonate with startup investors.

Chess, with its distinctive Opening, Middlegame, and Endgame, serves as a neat metaphor for a startup’s journey from launch to exit.

– Openings present an opportunity to dictate the terms of the exchange, the type of game that you want to play – or the type of game that your opponent doesn’t want to play. Most of Paul Graham’s “18 Mistakes That Kill Startups” happen at the beginning. Startup founders can relate to the importance of openings.

– Middlegames involve digging deep. Since middlegame positions are unique from game to game, memorisation of theoretical variations is not possible. As one Reddit user has commented: “The goal of the middlegame is to exaggerate the imbalances in your favor and mute those favoring your opponent.” During the startup middlegame, founders have to “roll with it”. They must take the rough with the smooth, mixing offense with defense to somehow find a way into the Endgame.

– Endgames speak for themselves. They are an especially delicate phase of the game, where mistakes have more serious consequences than in the opening. Many players find it hard to know for sure when they are in the endgame. When it comes to startups, even the most accomplished founders find exits difficult. Getting to checkmate and meaningful liquidity event is fraught with execution risk.

The mathematics of chess are so complex that ultimately, the game comes down to intuition and psychology. Creativity, too. Kasparov built his career on a peculiar mix of discipline and freedom, dispassionate calculation and iconoclastic ideas. The best founders do the same.

Implications for investors

We’ve already written about the ambivalent power of unintended consequences and how recognising them can help investors to manage risk more effectively.

When we evaluate the potential impact of our actions within a particular system, we tend to ignore the impacts of the system’s first-order responses to our actions, and indeed the second and third order responses to those responses.

Chess dramatises this inconvenient truth. It can help us to become more aware of how our decisions cascade and escalate over time.

At the heart of it all – chess, startups, life – is the crucial distinction between tactics and strategy. As the Polish chess player Savielly Tartakower said:

“Tactics is knowing what to do when there is something to do. Strategy is knowing what to do when there is nothing to do.”

Chess teaches us more than how to act in a given situation. It teaches us when to act. And that’s a useful skill for those who make a living from startup investing, a domain where timing is everything.

Work with Koble

At Koble, we’ve spent four years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of success.

We’re working with forward-thinking angels, VCs, family offices, and hedge funds to re-engineer startup investing with AI. If that resonates, get in touch.

Investor reading

💰 General Catalyst’s Hemant Taneja on AI, LPs, and raising around $8 billion – $4.5bn approximately is geared towards the firm’s VC funds; $1.5bn is for GC’s “creation” strategy; $2bn is geared towards “separately managed accounts".

📈 The Numbers Behind This Year’s Most Promising Startups – The technology world often fixates on how much startups raise. But perhaps more interesting are the companies that generate meaningful revenue without raising any venture capital at all.

💧 VC Firm Accel Files With SEC to Tap Thriving Secondary Market – Accel is the latest venture capital firm to consent to heightened regulation with the US SEC, a tradeoff that allows it to buy more shares of non-public companies that have been changing hands at steep discounts on private markets.

Some tweets

Parting shot

“The winner is just the player who made the next-to-last mistake.”

― Garry Kasparov

Regards from your [tactical / strategic] startup investing AI,

About Koble

Koble is re-engineering startup investing with AI, applying quantitative strategies that have disrupted public markets to early-stage startup investing.