Moneyball is a newsletter from Koble exploring the limitations of human decision-making and their implications for startup investing.

We’ve spent three years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of success.

This week

🧠 Mental Model #33 – On Madness – The World Lives On Crazy Things

📖 Investor reading – US Venture Capital Outlook: Midyear Update – Inside HSBC’s VC Charm Offensive – China Plans New Measures to Attract Venture Capital Investment

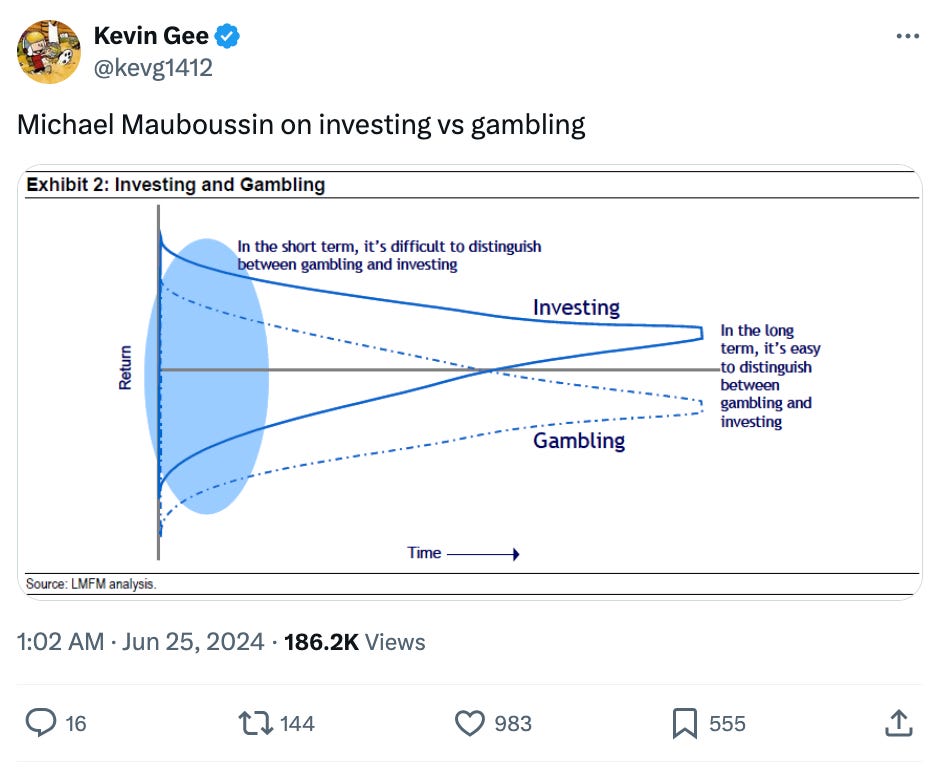

💬 Some tweets – Michael Mauboussin on investing vs gambling – Big venture platforms are launching PE funds – This genius who presented $NVR stock in the Value Investors Club back in 2001

“Madness is a rare thing in individuals – but in groups, parties, peoples, and ages it is the rule.”

– Friedrich Nietzsche

We live in a world that abhors madness. But if you look at the history of the greatest startups, madness is a common theme.

Steve Jobs understood the fine line between madness and genius. In 1997 he said:

“Here’s to the crazy ones, the misfits, the rebels, the troublemakers, the round pegs in the square holes... the ones who see things differently... they push the human race forward, and while some may see them as the crazy ones, we see genius, because the ones who are crazy enough to think that they can change the world, are the ones who do.”

Jobs famously declared that Apple would dedicate itself to making tools for these misfits. But Apple’s relationship with abnormality went deeper than its target market; the company itself was a product of madness.

The company’s evolution from a weekly meet-up of Bay Area geeks (the Homebrew Computer Club) to the world’s most valuable company was driven by more than product innovation and marketing genius.

Apple relied upon an irrational, counter-intuitive belief in the beauty of technology, the unlikely passion of “computer geeks”, and the belief that people don’t know what they want until you show them.

Elon Musk is heir apparent to Job’s long-held title as the most interesting person in technology. He has big ideas (online payments, electric cars, reusable rocketry) that seem crazy but precipitate structural changes in thinking and doing that create massive new markets and opportunities for value creation. He lives and operates his technology empire by Joseph Campbell’s credo:

“The world lives on crazy things. The economics will work themselves out later – you can count on it.”

Musk is certainly an extraordinary storyteller, paradigm-shifter and world-builder, but he is also a ruthless self-publicist, and one senses that his craziness is somewhat confected; a sort of socially acceptable, even cool madness that is designed to drive clicks and dramatise his story.

The origins of Apple’s logo say a lot about the company’s singular DNA. Not the now iconic apple alluding to the fruits of humanity’s ingenuity and labour, but the original design that never made it to the back of our iPhones; an Victorian woodcut accompanied by a quote from William Wordsworth’s “The Prelude” which read:

“A mind forever voyaging through strange seas of thought, alone.”

Strange seas of thought… Chaotic. Frightening. Dangerous. What if these are the qualities that startup investors should be looking for, rather than the safety of reverse-engineered founding teams from reputable universities with oven-ready business models?

Implications for investors

Investors are generally scared of madness (and it’s cousin, genius). That is why they emphasise qualities like grit, determination, and tenacity – it’s a way to push through polished but mediocre founders that seem to be less risky bets, but end up building generic B2B SaaS startups.

Most of the startups paraded through TechCrunch and Sifted by boutique PR firms are the musical equivalent of boy/girl bands, manufactured by left-brained music executives who think too much and feel not enough.

To extend the analogy, the most promising startups are often more akin to idiosyncratic, hungry, rough-round-the-edges performers who know their instruments and play to put food on the table. Investors should be looking for the next Tracy Chapman or Van Morrison, but they are competing for allocations from Girls Aloud and One Direction.

Madness is rare in individuals. It’s even rarer in startups. Which is what makes it so interesting and valuable to investors.

Work with Koble

At Koble, we’ve spent three years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of success.

We’re working with forward-thinking angels, VCs, family offices, and hedge funds to re-engineer startup investing with AI. If that resonates, get in touch.

Investor reading

🇺🇸 US Venture Capital Outlook: Midyear Update – VCs and founders went into 2024 hoping for the best but preparing for the worst, and got something in between.

🏦 Inside HSBC’s VC Charm Offensive – The bank has snared roughly 300 startup clients over the last year, a figure management is hoping to grow into thousands.

🇨🇳 China Plans New Measures to Attract Venture Capital Investment – International investors will be able to set up yuan funds in China to facilitate domestic investments.

Some tweets

Parting shot

“No great mind has ever existed without a touch of madness.”

― Aristotle

Regards from your [crazy] startup investing AI,

About Koble

Koble is re-engineering startup investing with AI, applying quantitative strategies that have disrupted public markets to early-stage startup investing.