Moneyball is a fortnightly newsletter from Koble exploring the limitations of human decision-making and their implications for startup investing.

We’ve spent two years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of success.

This week

🧠 Mental Model #27 – False Uniqueness Effect – This Time It’s (Not) Different

📖 Investor reading – Mustafa Suleyman and Eric Schmidt: We need an AI equivalent of the IPCC – One of the biggest startup failures of all time, and venture capitalists haven't learned a thing – The SPVs Behind Venture Capital’s Biggest Bets

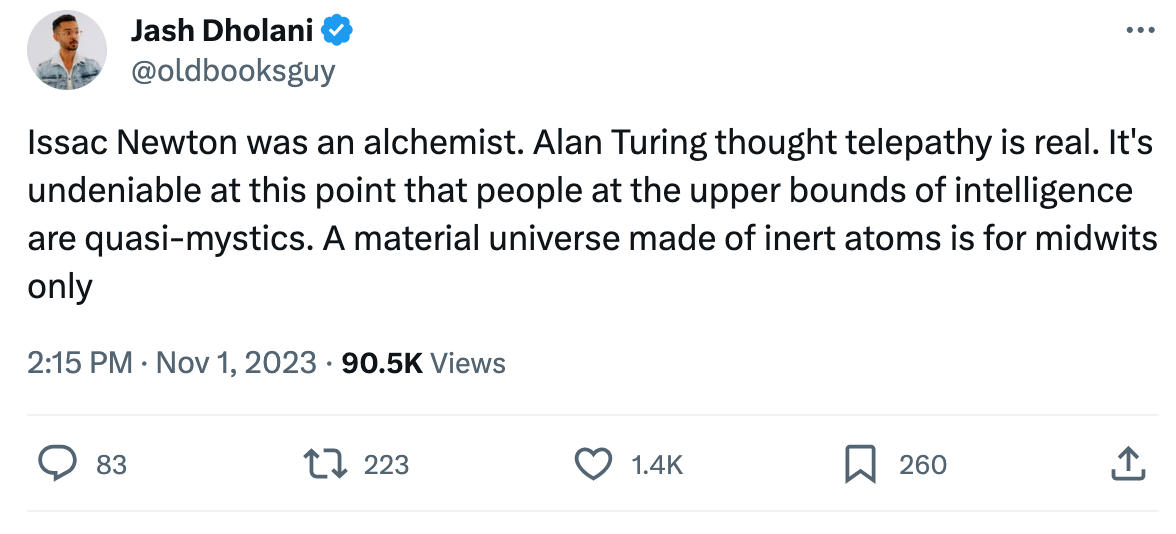

💬 Some tweets – “Idea” founders outsourcing tech are not getting funded any more – People at the upper bounds of intelligence – Guys making $250k per year

This Time It’s (Not) Different

We all like to think we’re unique. But how different are we really?

False Uniqueness refers to our tendency to overestimate our differences versus other people. Typically this entails underestimating the desirable qualities of others in comparison to ourselves.

It’s measured by looking at the difference between estimates that people make about how many of their peers share a certain trait, and the actual number of peers who report these traits.

The first mention of this phenomenon can be attributed to Linda Perloff and Philip Brickman, who in 1982 identified the “False Uniqueness Effect” when looking at how people perceive their own vulnerability to future events such as illness or death.

Since then, this effect has been explored and measured in a variety of contexts, such as psychological fear, honesty, athleticism, management, even driving.

Jerry Suls and Choi K. Wan have noted:

“A person expresses false uniqueness, an inaccurate social comparison, when that individual perceives that differences between his or her own attitudes, abilities, and behaviors and those of others are larger than they really are.”

Someone who is clinically depressed may not be aware that many other people experience profound sadness, and thus may feel that their suffering is more severe than that of others.

And students with high grades may overestimate the extent to which their academic achievements will open the doors to prestigious universities or jobs, because they’re not aware of the sheer volume of qualified applicants against whom they are competing. This year, Blackstone received applications from 62,000 candidates for 169 first-year analyst positions. How many of those applicants rated their chances of being hired?

The flip-side of this cognitive bias is the False Consensus Effect, in which people overestimate the extent to which their attitudes and behaviours are typical compared to those of others.

People like to pick and choose – they tend to attribute False Uniqueness to their desirable traits, but apply False Consensus to their negative ones.

We think we’re unique, but we’re not. This irresistible delusion pervades Venture Capital, affecting startups and investors in equal measure.

Startups love to talk about secrets, USPs, and unfair advantage. And yet, pitch decks are eerily homogeneous. Guy Kawasaki’s 10-side format (subject to some harmless inflation from founders who refuse to “murder their darlings”) has become the norm.

The language that founders use to talk about their products, business models, and company cultures is pretty uniform; testing, iterating, moving fast and breaking things…

And these days – the era of the low barrier to entry – it’s rare to find a startup doing something totally unique, even in capital-intensive industries like deeptech and clean energy. Most are competing with others in their niche, however narrow they have chosen to make it.

Implications for investors

Investors are even more prone to False Uniqueness. And the cut-and-paste VC website is the ultimate manifestation of homogeneity.

Websites are awash with buzzwords, with firms claiming to be founder-centric, operator-led, hands-on, and obsessed with helping startups. It makes no sense to frame these standard-issue traits as differentiators. VCs’ websites say “we are different”, but they scream “WE ARE THE SAME”.

In reality, Venture Capital is one of the most homogeneous industries out there. All funds are variations on the same theme (with the same tried and tested fee structure).

There is a Power Law, but it extends only to people and returns, not business models and brand positioning.

Work with Koble

At Koble, we’ve spent two years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of success.

We’re working with forward-thinking angels, VCs, family offices, and hedge funds to re-engineer startup investing with AI. If that resonates, get in touch.

Investor reading

🤖 Mustafa Suleyman and Eric Schmidt: We need an AI equivalent of the IPCC – “Trust, knowledge, expertise, impartiality. These are what effective, sensible AI regulation and safety will be built on. Currently they are lacking.”

☢️ “One of the biggest startup failures of all time, and VCs haven't learned a thing” – WeWork just isn’t working anymore, and the venture capitalists who backed the company when it was a high-flying startup haven't learned a thing from its disaster.

💰 The SPVs Behind Venture Capital’s Biggest Bets – You might have noticed that Thrive Capital has made a number of bold bets this year, leading massive investments in Stripe, Ramp and OpenAI – and SPVs are a key part of the strategy.

Some tweets

Parting shot

“He who would learn to fly one day must first learn to stand and walk and run and climb and dance; one cannot fly into flying.”

― Friedrich Nietzsche

Regards from your [unique] startup investing AI,

About Koble

Koble is re-engineering startup investing with AI, applying quantitative strategies that have disrupted public markets to early-stage startup investing.