Moneyball is a fortnightly newsletter from Koble exploring the limitations of human decision-making and their implications for startup investing.

We’ve spent two years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of success.

This week

🧠 Mental Model #26 – Cycles – Why Cycles Matter

📖 Investor reading – AI startups need more data centres, France wants to build them – EIF Venture Capital Survey 2023 – New research shows founder personality can dictate startup success

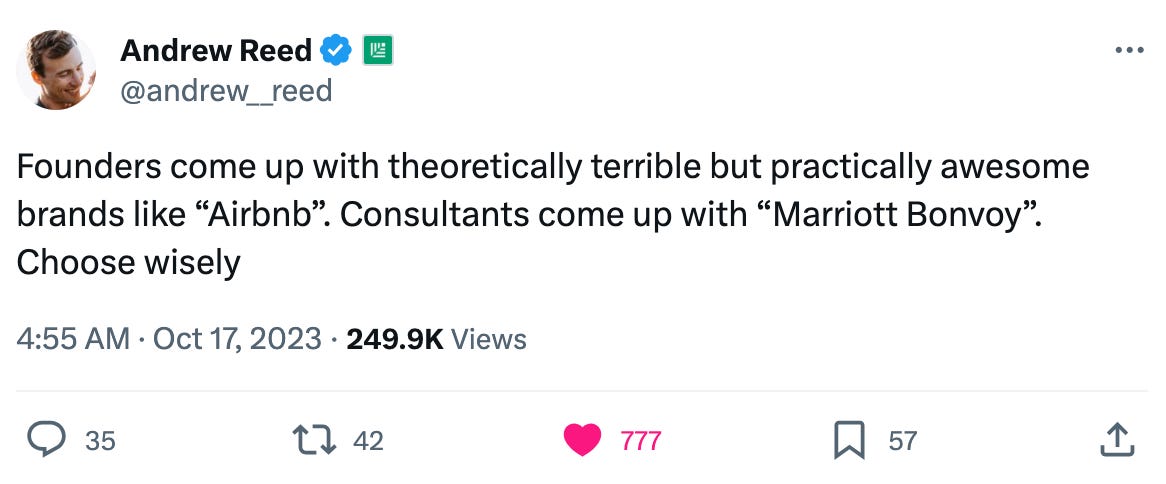

💬 Some tweets – Theoretically terrible but practically awesome brands – The state of VC in 2023 – The most salient lessons I learned

Why Cycles Matter

“To every thing there is a season, and a time to every purpose under the heaven:

A time to be born, and a time to die; a time to plant, a time to reap that which is planted;

A time to kill, and a time to heal; a time to break down, and a time to build up.”

Venture capital is in the doldrums right now.

For young(ish) investors who had not experienced a full economic cycle, the re-adjustment has been brutal. Bullish rhetoric – a sense that the Startup Winter would blow over and the good times would return before long – has given way to realism, perhaps even an air of resignation.

Many VCs have scaled back their plans. Some have left the industry entirely, taking the standard-issue pivot from “operator” to “investor” one step further. Back to “operator” it is, then.

The same goes for founders. The reality of raising capital in a myopic funding environment has sunk in, with startups taking extreme action to elongate runways and convince investors that they have “the capacity to suffer”.

There is a sense that the financial press are somehow enjoying this. After all, VCs are just Patagonia-wearing pseudo-intellectuals making educated bets on which meal delivery startup will scale faster, right? And founders are just life-style orientated geeks playing risky games with other people’s money, no?

The schadenfreude seeps through the blogs and tweets of commentators who simply “knew” that startup investing was a bubble. They were just a decade or so out in their ability to predict when the music would stop.

And everywhere we look, that word – “cycle”.

The concept of cycles is intrinsic to our humanity (without the reproductive cycle we would not be here to obsess over its distant cousins; economic, political, and cultural). Hegel nailed it when he said that:

“We learn from history that we do not learn from history.”

Cycles are well trodden territory in the literature of public markets, but they’re under-explored within the context of startup investing, perhaps because startup investing hasn’t been around for that long compared to other asset classes?

Clearly macroeconomic cycles have a massive impact on investment returns. The risk-free rate drives the cost of capital for VCs and startups. The massive rise in underlying rates has cleared out a lot of so-called “dead wood” – investors and founders who failed to create value for LPs and society at large.

But what about the “good wood”? What about all those startups that could have gone on to drive innovation and progress if they hadn’t lost access to capital?

Back in 2013, researchers at Harvard Business School produced a paper on “Investment cycles and startup innovation”, examining both the financial outcomes and the innovation outcomes of firms that received early stage venture capital financing between 1985 and 2004. This is required reading for policymakers who like to drop buzzwords like “productivity”, “innovation”, and “growth”.

The paper found that venture capital-backed startups receiving initial investment in “hot markets”:

“… are more likely to go bankrupt, but conditional on going public, are valued higher on the day of their initial public offering, have more patents, and have more citations to their patents.”

VCs (especially the most experienced and competent ones) invest in riskier, more innovative startups in hot markets. Crucially:

“Increased capital in hot times plays a causal role in shifting investments to more novel startups by lowering the cost of experimentation for early stage investors.”

The past teaches us that structurally significant industries such as semiconductors, biotech, the internet, fintech, and new materials would not have emerged without “hot markets” for venture capital.

Implications for investors (and policymakers)

In order to solve the “hard” problems that confront our world – climate change, wealth inequality, public healthcare to name but a few – we need a new wave of deep innovation. That can only happen through the provision of risk capital.

“Bubbles”, “FOMO”, and “VCs Congratulating Themselves” are a critical part of this process. As Eric Ries has pointed out:

“It doesn't matter if you call it a boom or a bubble. The startup business moves in cycles, and what goes up will eventually come down.”

The emergence of founders with “crazy” new technologies and business models is not a given. Irrational exuberance creates the economic and cultural conditions required for risk-taking to happen.

Much has been made of the fact that many successful firms were founded in recessions. Well over half of the companies on the 2009 Fortune 500 list were founded during a recession or bear market.

It’s true that firms founded in cold markets are less likely to go bankrupt and more likely to go public, but these firms are less likely to be in the tails of the distribution of outcomes.

Risk works both ways – reduce the downside, you reduce the upside, too.

Turn on Bloomberg TV. Everyone’s jabbering on about what the cycle means for stocks, bonds, and commodities. Some are flagging the implications for private equity and venture capital. But very few, if any, have identified the salient and terrifying truth that materially higher rates means materially lower progress for our species.

We need a new conversation. About productivity, long-term growth, and flowering the human experience. Understandably, in the current environment people seem to be more interested in jobs, mortgages, and the cost of living.

But the real cost of living is far greater than everyone thinks. And without the promise of meaningful technological progress, there will come a day when we won’t be able to pay it.

Work with Koble

At Koble, we’ve spent two years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of success.

We’re working with forward-thinking angels, VCs, family offices, and hedge funds to re-engineer startup investing with AI. If that resonates, get in touch.

Investor reading

🇫🇷 AI startups need more data centres, France wants to build them – Private cloud providers in France are investing in compute resources for European AI startups. But will it be enough to compete against US tech giants?

💰 EIF Venture Capital Survey 2023 – The paper focuses on the market sentiment as well as on issues related to scale-up financing and EU strategic autonomy.

🤩 New research shows founder personality can dictate startup success – Using a five-factor model to prove that personalities of founders are the most influential factor in startup success.

Some tweets

Parting shot

“The demon that you can swallow gives you its power, and the greater life’s pain, the greater life’s reply.”

― Joseph Campbell

Regards from your [acyclic] startup investing AI,

About Koble

Koble is re-engineering startup investing with AI, applying quantitative strategies that have disrupted public markets to early-stage startup investing.