Moneyball is a fortnightly newsletter from Koble exploring the limitations of human decision-making and their implications for startup investing.

We’ve spent two years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of success.

This week

🧠 Mental Model #20 – Iatrogenics – Investors, first do no harm

📖 Investor reading – VCs face an existential threat: there are too many of them – Fund of funds could be the perfect vehicle for backing diverse emerging fund managers – AI is coming for mathematics, too

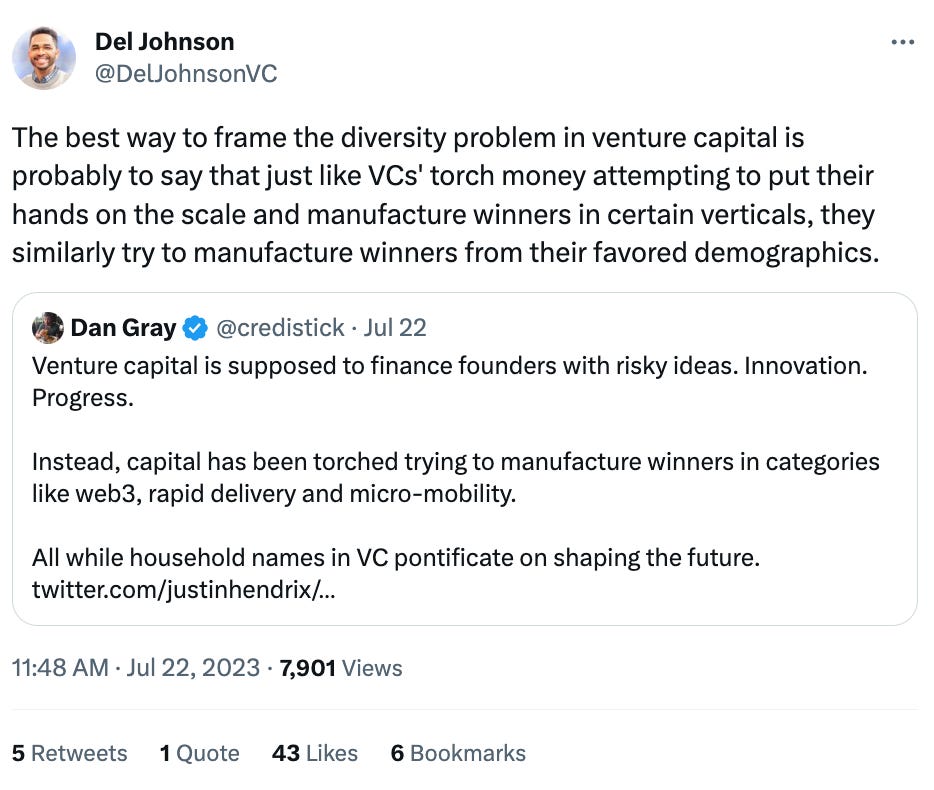

💬 Some tweets – Venture capital is “not a get rich quick game, it’s a get rich slow game” – The best way to frame the diversity problem in venture capital – Nvidia has also become one of the biggest investors in cloud and AI software startups

Investors, first do no harm

“First, do no harm.”

That is the oath doctors take (or at least supposed to take) before practicing medicine. Perhaps VCs should make the same promise to founders?

Iatrogenics is an obscure word that should be added to the venture capital lexicon. It (roughly) means “harm caused by the healer”, and has a lot to teach us about the investor-founder dynamic.

Iatrogenic illnesses are the third leading killer of Americans behind heart disease and cancer. Every year, more than 250,000 Americans die from medical errors. Medical doctors are thousands of times more likely to kill someone than gun owners. And death rates go down during doctors’ strikes.

Iatrogenics is everywhere you look in startup investing. A random trawl of VC websites throws up the same sales pitch again and again. “Smart money”, “value-add”, “acceleration”, “optimisation”, “domain expertise”, “founder coaching”, “partnership”, “portfolio value creation”.

Most VCs seek to add value; to generate alpha for their LPs through intervention in startups. Founders respond to this messaging. But is this really what the best founders are looking for? What if the rarest founders – ones who generate the fat-tailed returns that keep the VC industry afloat – don’t buy this approach? What if they actively reject it?

Whilst building Koble, we’ve lost count of the number of times smart, engaged, good people have told us that a pure Quant VC can’t get access to the best deals.

It makes sense on a superficial level, because “PVC” perpetuates the self-image of VCs and the dominant narrative in the unicorn industry (one lampooned by a growing number of satirical Twitter accounts inspired by @VCBrags (full name; “VCs Congratulating Themselves”).

But we don’t buy it. Clearly, VCs can add value, but most don’t. The two value props of VC (money and advice) have become tangled – why should someone who is good at deploying capital be good at giving advice?

We believe there is an opportunity to build a new kind of brand around non-interventionary, laissez-faire, AI-centric investing.

Sophisticated founders are skeptical of the cut-and-paste VC pitch. They’re increasingly looking for speed, flat terms, and a progressive investment approach.

Well-intentioned investors have a tendency to interfere with things they cannot fully understand. The second-order consequences of intervention are hard (impossible) to model, so most people discount them. That doesn’t mean they’re not real.

Rather than spending time getting to know founders before investing and trusting them to execute on their unique vision, many VCs rush into FOMO-driven investments only to micromanage founders, diluting powerful people and bold ideas.

Surveillance is a cornerstone of the VC modus operandi, with investors closely tracking KPIs to ensure startups hit their milestones and deliver ROI. This approach stems from a flawed understanding of startup risk (and return). The unintended consequences of such hands-on techniques risk destroying the very value that interventionary VCs seek to generate.

The constant pressure to meet short-term targets leads to a myopic focus on short-term gains, hampering a startups’ ability to deliver long-term value creation. The result is mean-reversion.

Implications for investors

First, do no harm.

The best founders (and investors) know that great products are built through tinkering, not strategic planning. Startups learn by doing. That’s why good founders like to work with investors who have built things. Ex-founders (even the failed variety) understand that the path to massive enterprise value is composed of small steps.

Marc Andreesen gets it. He says:

“It’s important to really internalize that the founders of a startup are the ones who have to make a startup succeed. The best assumption to make is that your VC's primary value add is the cash they are investing.”

In the good times (low rates, low volatility, low barriers to entry), founders could pick and choose who to let into their cap tables. When capital was a commodity, VCs were compelled to elevate themselves by emphasising their value-additive approach.

Now the good times are over and VC is adapting to a new macroeconomic context in which the cost of capital has risen along with opportunity costs, expectations, and exogenous risks. Founders are less discerning, more pragmatic. Their priority is access to capital.

Of course, the very best founders can still pick and choose. But do they really opt to work with household-name VCs because of their domain expertise? Or could it have something to do with their limitless financial firepower and ability to move quickly?

One thing is irrefutable – when it comes to access and allocations, brand matters. Most VCs think that building a brand means adding value through old school relationship management, quasi-consulting activities, domain expertise. But in truth, there is no such thing as a “startup expert”. Every startup is different. As Tolstoy wrote in Anna Karenina:

“All happy startups are alike; each unhappy startup is unhappy in its own way.”

In the AI era, VC brand construction will play out differently, and algorithms will get allocations. Their pitch to founders? Speed, convenience, scale, and the freedom to build without looking over your shoulder.

Who can say no to that?

Work with Koble

At Koble, we’ve spent two years developing our groundbreaking algorithms, which discover early-stage startups that outperform the market and predict their probability of success.

We’re working with forward-thinking angels, VCs, family offices, and hedge funds to re-engineer startup investing with AI. If that resonates, get in touch.

Investor reading

💥 VCs face an existential threat: there are too many of them – The venture industry needs to shrink to adjust to the new normal, and even the VCs themselves know it.

💰 Fund of funds could be the perfect vehicle for backing diverse, emerging fund managers – The fund-of-funds model has a new role to play in the venture ecosystem as the amount of capital allotted to such funds has declined over the years.

🧮 AI is coming for mathematics, too – Mathematicians are grappling with the latest transformative force: Artificial Intelligence.

Some tweets

Parting shot

“The nine most terrifying words in the English language are: I’m from the Government, and I’m here to help.”

– Ronald Reagan

Regards from your [laissez-faire] startup investing AI,

About Koble

Koble is re-engineering startup investing with AI, applying quantitative strategies that have disrupted public markets to early-stage startup investing.